Warren Buffett: Investment Strategies of the Oracle of Omaha

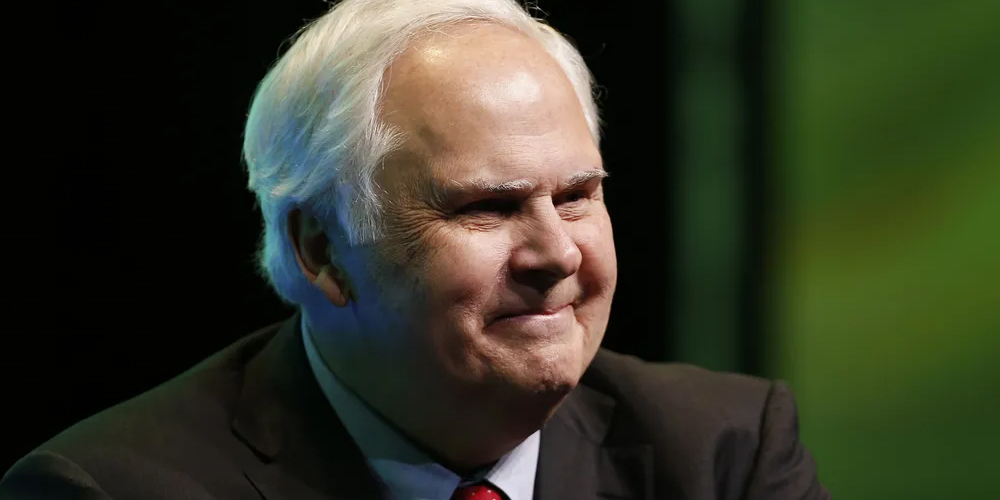

Warren Buffett is one of the most renowned investors in history. Known as the “Oracle of Omaha,” his investment strategies have garnered attention worldwide. Buffett’s approach combines analytical thinking with a profound understanding of human behavior. This article delves into his life, investment philosophy, and the principles that have led to his remarkable success.

Early Life and Background

Humble Beginnings

Warren Edward Buffett was born on August 30, 1930, in Omaha, Nebraska. His father, Howard Buffett, was a stockbroker and Congressman, which sparked Warren’s interest in finance early on. As a child, he displayed entrepreneurial skills, selling gum and Coca-Cola door-to-door.

Education and Early Career

Buffett attended the University of Nebraska, where he earned a Bachelor of Science in Business Administration. Later, he pursued a Master’s degree at Columbia University. There, he studied under Benjamin Graham, known as the father of value investing. This experience shaped Buffett’s investment philosophy profoundly.

The Formation of Berkshire Hathaway

Acquisition of Berkshire Hathaway

In 1965, Buffett took control of Berkshire Hathaway, a struggling textile company. He saw potential in the business model and decided to invest. Over time, he shifted the focus of Berkshire Hathaway from textiles to a diversified holding company.

Building a Diversified Portfolio

Buffett’s strategy involved acquiring companies with strong fundamentals. He sought businesses with competitive advantages and solid management teams. This approach allowed him to build a diverse portfolio, including insurance, utilities, and consumer goods.

Investment Philosophy

Value Investing

Buffett is a proponent of value investing, a strategy focused on identifying undervalued companies. He looks for stocks that are trading below their intrinsic value. This method requires extensive research and patience, allowing investors to capitalize on long-term growth.

The Importance of Moats

A key concept in Buffett’s investment philosophy is the economic moat. A moat is a competitive advantage that protects a company’s market share. Companies with strong moats are more likely to withstand competition and economic downturns. Buffett often invests in businesses with recognizable brands and loyal customer bases.

The Power of Long-Term Thinking

Holding for the Long Haul

Buffett’s success can be attributed to his long-term perspective. He believes in holding investments for years, allowing them to grow. This patience distinguishes him from many investors who seek quick profits. By focusing on long-term value, Buffett can ride out market fluctuations.

Compound Interest: The Eighth Wonder

Buffett famously refers to compound interest as the “eighth wonder of the world.” He emphasizes the importance of reinvesting earnings to maximize returns over time. This principle is fundamental to his investment strategy and serves as a lesson for aspiring investors.

Risk Management

Understanding Risk

Buffett has a unique approach to risk management. He believes that understanding what you are investing in is crucial. By conducting thorough research, investors can make informed decisions and mitigate risks effectively.

Margin of Safety

Another vital aspect of Buffett’s philosophy is the margin of safety. This principle involves investing in stocks that are significantly undervalued. A margin of safety provides a cushion against potential losses, ensuring a lower risk profile.

Philanthropy and Giving Back

The Giving Pledge

Warren Buffett is not only known for his investment acumen but also for his philanthropic efforts. In 2006, he pledged to give away the majority of his wealth to charitable causes. He co-founded the Giving Pledge with Bill and Melinda Gates, encouraging billionaires to commit to philanthropy.

Focus on Education and Health

Buffett’s charitable contributions primarily focus on education and health initiatives. He believes in investing in people, providing them with opportunities to thrive. His commitment to giving back reflects his belief in using wealth for the greater good.

Lessons from Warren Buffett

The Value of Patience

One of the most significant lessons from Buffett is the value of patience. Investing is not a sprint but a marathon. By adopting a long-term perspective, investors can navigate the ups and downs of the market more effectively.

Continuous Learning

Buffett emphasizes the importance of continuous learning. He spends hours reading daily, absorbing information about businesses and industries. This dedication to knowledge allows him to make informed decisions and adapt to changing market conditions.

Surrounding Yourself with the Right People

Buffett advocates for surrounding yourself with knowledgeable and trustworthy individuals. The right partners and advisors can provide valuable insights and enhance decision-making. Building a strong team is essential for achieving success in any venture.

Conclusion

Warren Buffett’s investment strategies have made him a legendary figure in the finance world. His commitment to value investing, long-term thinking, and risk management has yielded remarkable results. Moreover, his philanthropic efforts demonstrate his belief in using wealth for positive change.

By studying Buffett’s principles, aspiring investors can gain valuable insights into building wealth. His story serves as a reminder that success requires patience, continuous learning, and a genuine desire to make a difference. As the “Oracle of Omaha,” Warren Buffett’s legacy will undoubtedly inspire future generations.