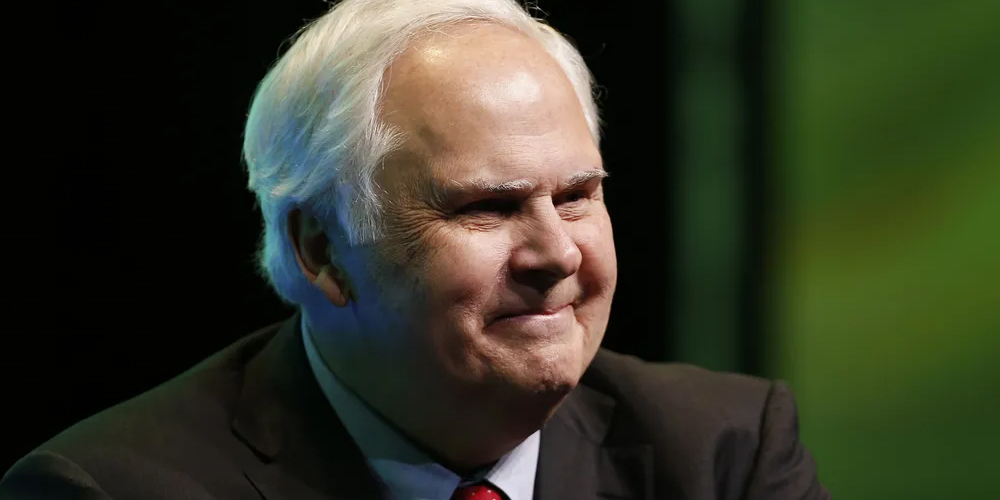

The Influence of Ray Dalio in Investment Management

Ray Dalio, the founder of Bridgewater Associates, has profoundly impacted the world of investment management. Known for his unique principles and innovative strategies, Dalio’s approach to investing and economics offers valuable lessons for investors and business leaders alike. This article explores his journey, investment philosophy, and the principles that have shaped his success.

Early Life and Education

Ray Dalio was born in 1949 in Jackson Heights, New York. He grew up in a middle-class family and developed an early interest in finance. At age 12, he started investing in the stock market, using a $300 investment he had saved from working as a paperboy. This early exposure laid the foundation for his future career.

Dalio attended Long Island University and later earned an MBA from Harvard Business School. After graduating, he began his career on Wall Street, working at several investment firms before founding Bridgewater Associates in 1975.

The Founding of Bridgewater Associates

Bridgewater Associates started as a small advisory firm. However, Dalio’s innovative approach quickly attracted attention. He emphasized radical transparency and encouraged open communication among employees. This unique culture fostered a sense of trust and collaboration, essential for success.

Under Dalio’s leadership, Bridgewater grew to become one of the largest hedge funds globally, managing over $160 billion in assets. His commitment to data-driven decision-making and rigorous analysis set Bridgewater apart in the competitive landscape of investment management.

Investment Philosophy

Dalio’s investment philosophy revolves around understanding economic cycles and making informed decisions based on data and research. He developed a framework called “The Economic Machine,” which explains how economies function. This model emphasizes the importance of understanding debt cycles, productivity, and inflation.

Dalio believes that successful investing requires a combination of knowledge, experience, and emotional discipline. He often stresses the need for investors to be aware of their biases and to approach decisions objectively.

Radical Transparency and Principles

One of Dalio’s most significant contributions to business culture is his advocacy for radical transparency. He encourages open discussions about mistakes and failures, promoting a learning environment. This approach not only enhances decision-making but also fosters a culture of accountability.

Dalio also authored “Principles: Life and Work,” a book that outlines his core principles for success. The book provides insights into his philosophy and serves as a guide for individuals seeking to improve their decision-making processes. The principles focus on the importance of radical truthfulness, embracing reality, and learning from failures.

Impact on Investment Management

Ray Dalio’s influence on investment management extends beyond Bridgewater Associates. His insights into economic cycles and investment strategies have reshaped how investors approach the market. Many financial institutions now incorporate elements of Dalio’s philosophy into their investment strategies.

Dalio’s focus on data-driven decision-making has also led to the increased use of technology in investing. His emphasis on using algorithms and quantitative analysis has inspired many hedge funds to adopt similar approaches.

Philanthropy and Global Impact

In addition to his contributions to investment management, Dalio is committed to philanthropy. He established the Dalio Foundation, which supports various initiatives in education, healthcare, and ocean exploration. His philanthropic efforts reflect his belief in using wealth to create positive change in the world.

Dalio is also a vocal advocate for understanding and addressing global challenges, such as income inequality and climate change. He often discusses the importance of collaboration among leaders to solve these pressing issues.

Legacy and Future Outlook

Ray Dalio’s legacy in investment management is significant. His innovative approaches and principles continue to influence investors and business leaders. As the financial landscape evolves, Dalio’s insights will likely remain relevant.

Looking ahead, Dalio emphasizes the need for adaptability in investment strategies. The rapid pace of technological change and global events requires investors to be flexible and informed. Dalio’s focus on lifelong learning and openness to change will serve as valuable lessons for future generations.

Conclusion

Ray Dalio’s influence on investment management is profound and far-reaching. His journey from a paperboy to the founder of one of the largest hedge funds showcases his dedication and innovative thinking. By promoting radical transparency, data-driven decision-making, and a commitment to learning, Dalio has reshaped the investment landscape.

As investors face new challenges, Dalio’s principles and insights will continue to guide them. His commitment to philanthropy and addressing global issues further solidifies his legacy as a leader in both finance and social responsibility. For anyone interested in investing, Ray Dalio’s story serves as an inspiration and a reminder of the power of thoughtful decision-making